let us worry about your books

Bookkeeping in Florida

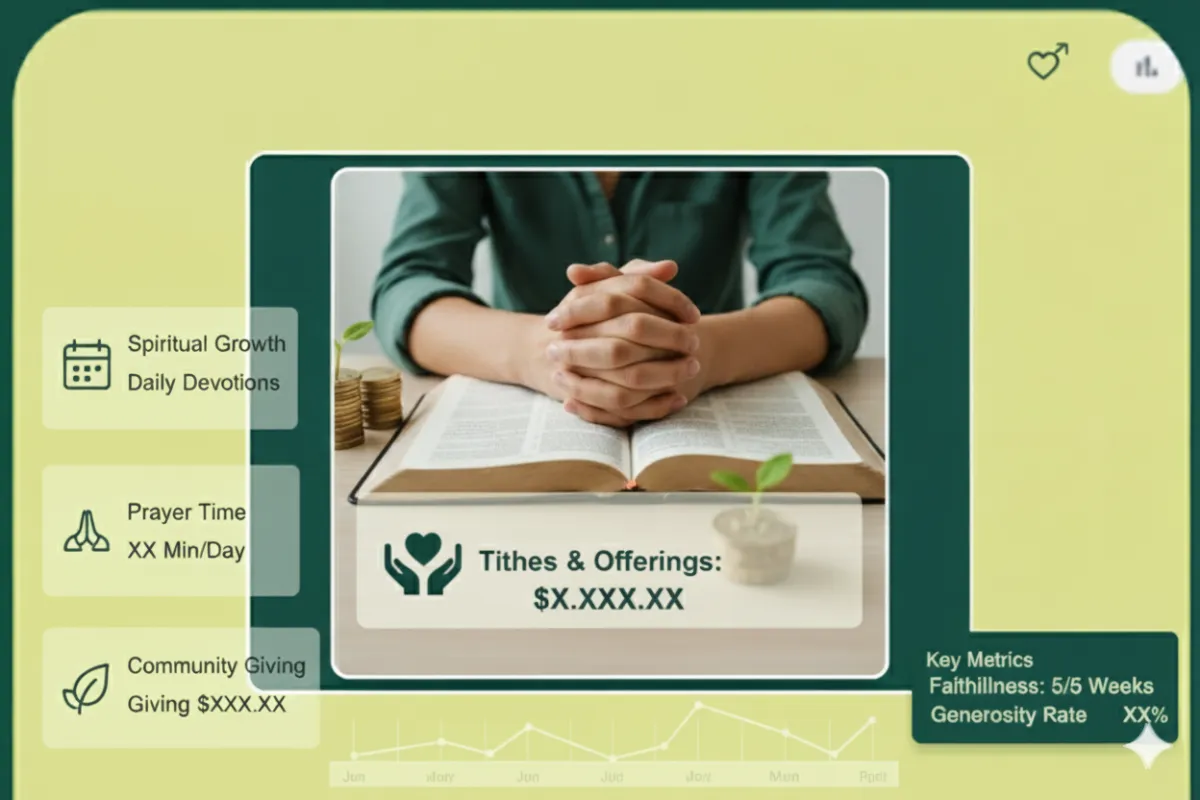

Faithfully stewarded bookkeeping and payroll services

God

Faith-based bookkeeping

About Us

Your Faith-Driven Partner in Bookkeeping

We proudly serve all businesses, with a special focus on faith-driven businesses as our niche.

Our Purpose

Our purpose is to serve businesses with God-honoring stewardship, providing clear and accurate financials so owners can grow with confidence.

Who We’re a Good Fit For

• Private Practice Providers

• Small Businesses Ready to Grow

• Backlogged or Unmanaged Books

• Faith-Centered Entrepreneurs

• Clients Needing Ongoing Stewardship

Our Faith

Our faith is the foundation of how we serve, with integrity, stewardship, and trust in God guiding every step.

Our Services

Tailored Bookkeeping to

Meet Your Needs

Outsourcing your bookkeeping to Anchored Ledger Firm gives you peace of mind, while freeing you up to lead, grow, and serve.

Judgment-free reset for your books

Consistent support you can count on

Behind on your books?

Stress-free payroll processing

We provide financial clarity

Learn to support your books

Why Choose Us

Building Trust with God-Fearing Bookkeeping Solutions for Financial Success

We emphasize transparency, reliability, and tailored support to ensure a smooth path toward confident decision-making and growth.

Trusted Expertise

Our team of seasoned bookkeeping specialists ensures accuracy and efficiency by providing expert guidance tailored to your business needs.

Faith-Guided Stewardship

Our work is grounded in integrity and trust, ensuring your books are managed with excellence and God-honoring values.

Tailored Bookkeeping Support

We provide personalized solutions designed to fit your business needs, delivering clarity and confidence in every financial detail.

Your QuickBooks guide

Beginner’s Guide to Taking Control of Your Finances

This beginner-friendly guide walks you through QuickBooks step by step, making bookkeeping simple and approachable. With clear instructions and practical tips, you’ll gain the confidence to take control of your finances once and for all.

Financial Wisdom

Empowering Your Financial Journey

At Anchored Ledger, we provide smart bookkeeping solutions to help you achieve your financial peace. With expert guidance and tailored options, we ensure you make informed decisions every step of the way.

Medical

Daycare

OnlineCoaches

Marketing

Home Remodel

+15yrs

Held accountable by

God

Relationship based clients

Love

Transparent and guide you along the way

Trust

Testimonial

Genuine Reviews From

Satisfied Customers

Chelsea brings a high level of care and precision to her work. The attention to detail and professionalism would make her highly reliable in any bookkeeping role. I’ve found her work to be trustworthy, thorough, and consistently thoughtful!

Dr. Adan Cheema

July 23, 2025

I knew I could trust her to be up to date on guidelines and requirements to ensure my work was accurately conveyed to both internal and external interested parties. Because of this trust, I was able to focus my attention toward my clinical work and not need to dedicate mental energy toward double checking whether my work was receiving fair credit.

Dr. Joseph Benert

July 23, 2025

Frequently Asked Questions

Common Bookkeeping

Questions And Answers

What’s the difference between bookkeeping and accounting?

Bookkeeping focuses on recording daily financial transactions things like sales, expenses, payroll, and bank reconciliations. Accounting goes a step further by analyzing this data to prepare reports, financial statements, and provide strategic advice. Bookkeeping is the foundation; accounting builds insights from it.

How often should I update my books?

Ideally, bookkeeping should be updated weekly or monthly. Regular updates ensure you always know your cash flow, can prepare for taxes on time, and make better business decisions. Waiting until year-end can create errors, missed deductions, and financial stress.

Why do I need bookkeeping if I have accounting software?

Software makes data entry easier, but it still requires accuracy. A bookkeeper ensures transactions are categorized correctly, reconciles accounts, and catches mistakes software might miss. Without proper bookkeeping, reports generated by software may be misleading.

Can I do my own bookkeeping, or should I hire someone?

Small businesses can start by doing their own bookkeeping if they have simple transactions. However, as the business grows (more clients, employees, invoices, etc.), hiring a bookkeeper saves time, ensures compliance, and reduces costly errors. Many businesses find the time saved outweighs the cost.